Key Takeaways

Why is XRP drawing attention despite weak price action?

Ripple’s $1 billion acquisitions signaled strong institutional intent, but XRP remains muted as short-term conviction stays flat.

What risks does XRP face in the near term?

With longs dominating over 70% of Binance’s perps and the market still risk-off, Ripple’s breakout could face cascading long squeezes.

Ripple [XRP] has been in the news a lot lately, and for once, it’s all bullish.

This week, Ripple’s $1 billion acquisitions triggered a media frenzy, with many calling this a key inflection point for XRP’s institutional adoption. The GTreasury deal alone cracks open access to the $120 trillion market.

Long term, serious capital is ready to flow into the XRPL. However, the “hype” fizzled almost as fast as it started, with little impact on XRP price action, showing that short-term conviction is still holding flat.

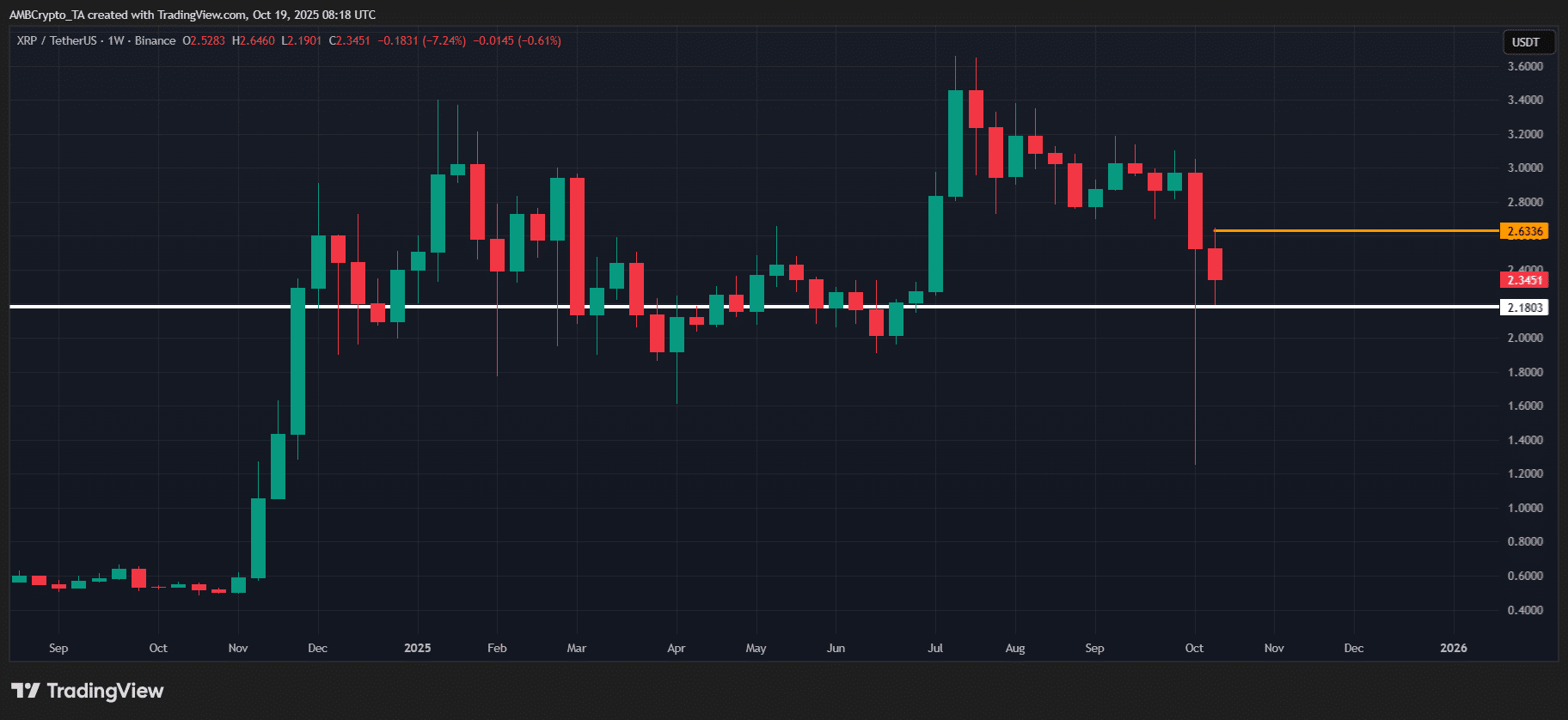

On the chart, XRP has kicked off Q4 as the worst-performing asset among the top five large-caps, dropping 17% over the month. This lines up with the “cautious optimism” thesis AMBCrypto flagged in its recent analysis.

Against this backdrop, Ripple’s perp market stays heavily skewed.

On Binance, longs have dominated over 70% of the 24H XRP/USDT perpetual volume this month. However, does the broader market really support t

Go to Source to See Full Article

Author: Ritika Gupta