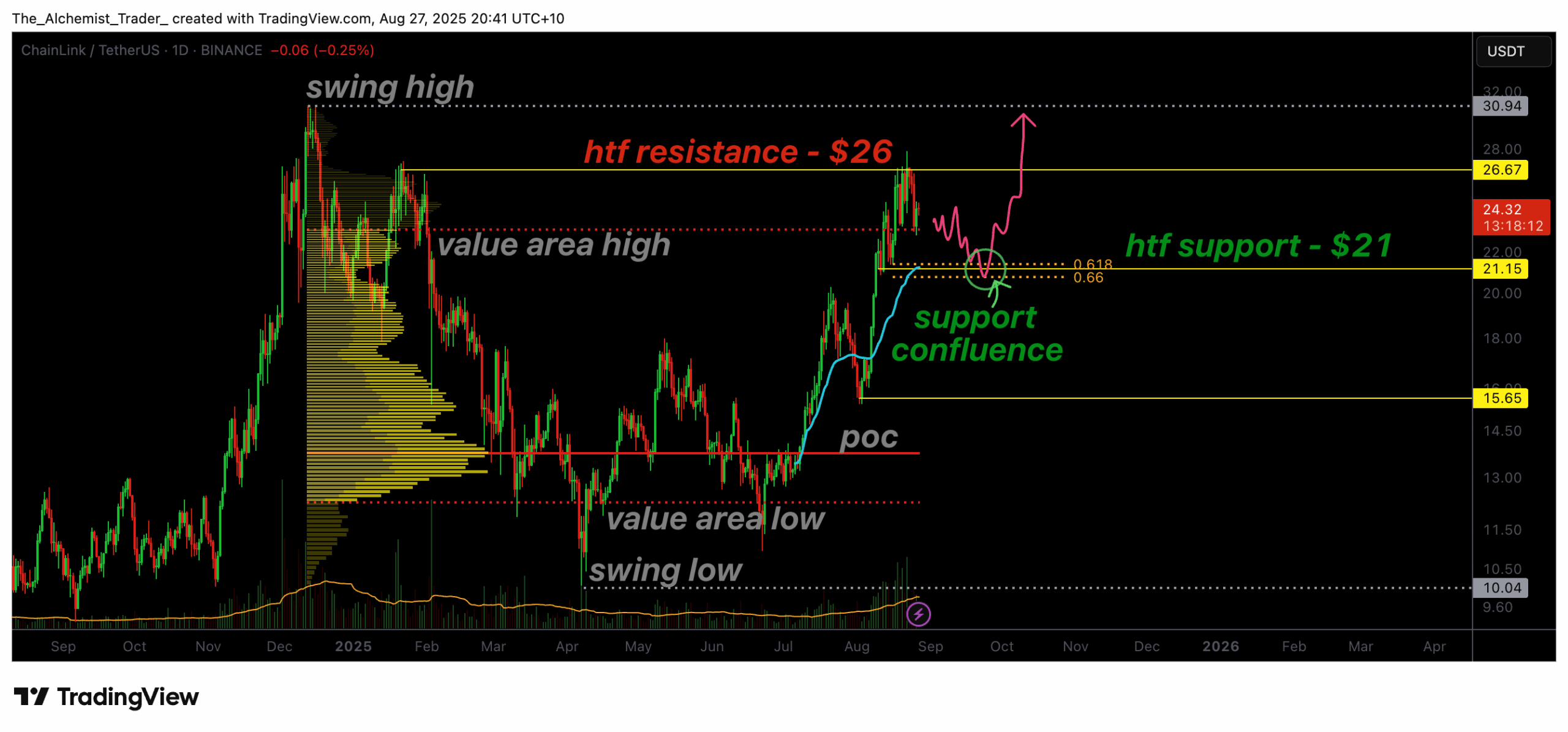

Chainlink price has once again been rejected from the $26 high-timeframe resistance. The next key test lies at $21 support, where confluence with Fibonacci and VWAP will determine the trend’s direction.

Summary

- LINK rejected from $26 resistance, a high time frame barrier.

- $21 support aligns with 0.618 Fibonacci, VWAP, and daily level.

- Bullish continuation depends on strong demand and volume confirmation at support.

Chainlink (LINK) has been repeatedly capped at the $26 resistance level, a barrier that has proven difficult to breach across multiple attempts despite bullish developments stemming from a potential Chainlink ETF. Price action is now setting up for a potential retest of the $21 zone, a high-confluence level that will define whether the bullish structure remains intact. Traders are closely monitoring this area, as holding $21 will reinforce higher-low projections, while losing it could shift momentum to the downside.

Key Chainlink price technical points

- Rejection at $26 Resistance: High time frame resistance continues to cap price action.

- Critical Support at $21: Aligned with the 0.618 Fibonacci retracement, VWAP, and daily support zone.

- Accumulation Potential: Price may consolidate around the value area high before attempting another breakout.

The $26 region has acted as a stubborn ceiling for LINK, rejecting bullish momentum multiple times. Each rejection underscores the strength of this level, making it a key hurdle to clear before LINK can pursue higher objectives. Despite this, the bullish structure remains intact as long as higher lows are preserved.

The $21 support is the most critical level to monitor in the short term. This zone is reinforced by m

Go to Source to See Full Article

Author: Aziz Zamani