- Bitcoin saw 47K BTC outflows, but the price remained somewhat stable on the charts

- Exchange reserves have continued to decline across the market

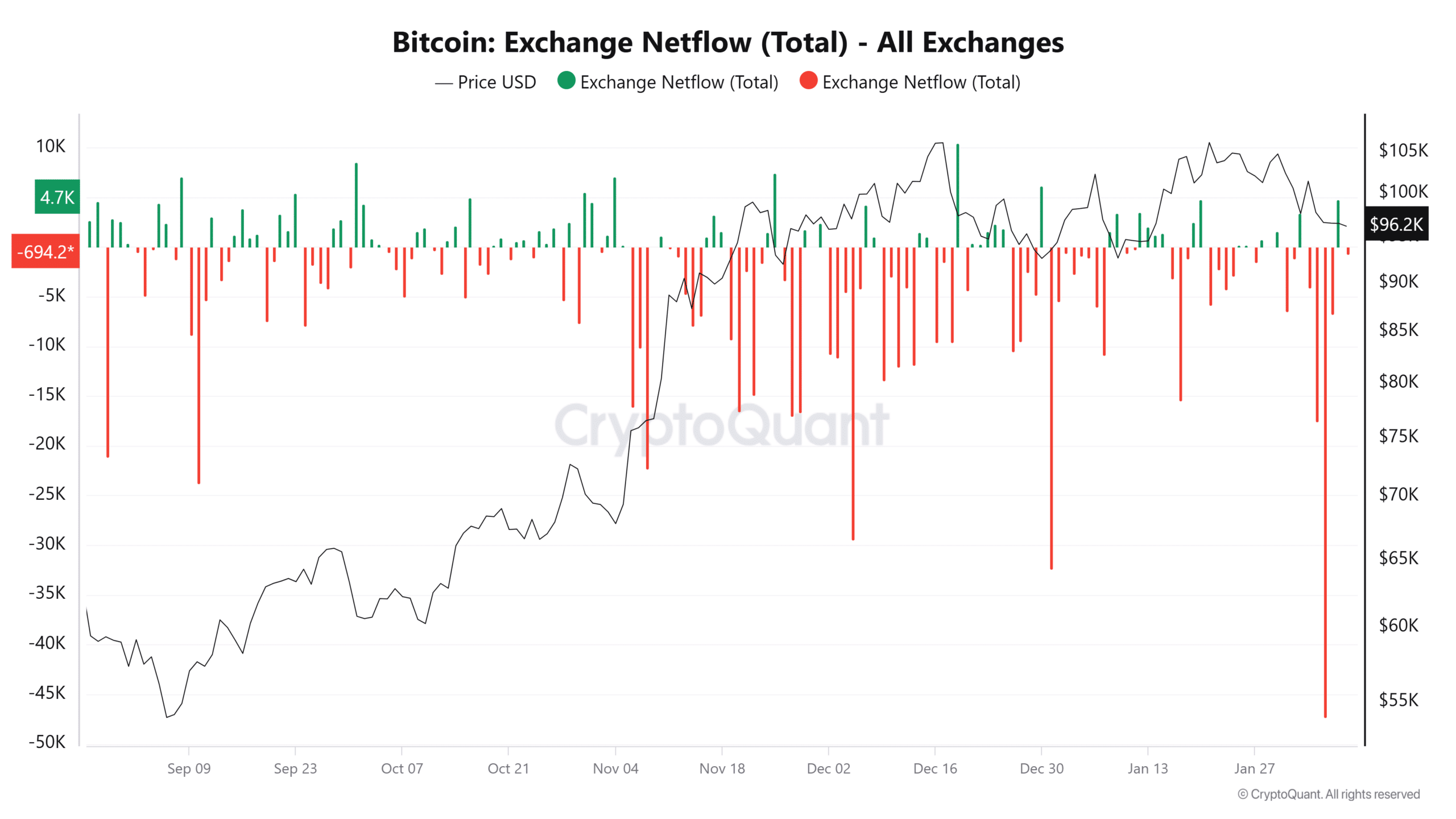

Bitcoin recently saw a significant outflow of 47,000 BTC, a movement that has sparked debate on whether it represents a true supply shock or a routine internal transaction. Historically, large outflows have been associated with long-term accumulation, reducing BTC’s liquid supply and potentially setting the stage for bullish momentum.

However, this latest move requires a closer look at on-chain data and price action.

Analyzing Bitcoin exchange reserves – Is accumulation in play?

An analysis of Bitcoin‘s netflows showed that it has been seeing significant outflows, before the spike it witnessed a few days ago. BTC outflows spiked to over 47,000 BTC, making it the largest such move since 2022.

The significance of these outflows led to talks about a supply shock. However, this alone did not quite confirm a supply shock.

Also, the Bitcoin Exchange Reserve chart revealed a sustained decline in BTC held across exchanges, dropping from over 3 million BTC in mid-2024 to around 2.45 million BTC in February 2025.

A shrinking exchange balance typically means investors are moving BTC to private wallets for long-term holding, reducing the supply available for immediate sale.

How did Bitcoin’s price react?

Following the outflows,

Go to Source to See Full Article

Author: Adewale Olarinde