- Solana needs to hold the $200 to target a surge to $220 as Trump’s inauguration draws nearer

- However, traders shouldn’t expect smooth sailing anytime soon

No doubt, investors have pounced on the oversold signal from Solana, sending its trading volume soaring by nearly 60%. This surge triggered a powerful green candlestick, with SOL jumping by an impressive 9% in just one day to reclaim $200 – A level it hadn’t touched in a week.

Now, speculations are rife, with many eyeing a potential rally to $220 in the short-term. Let’s break down the odds.

Investors need to show more confidence in Solana

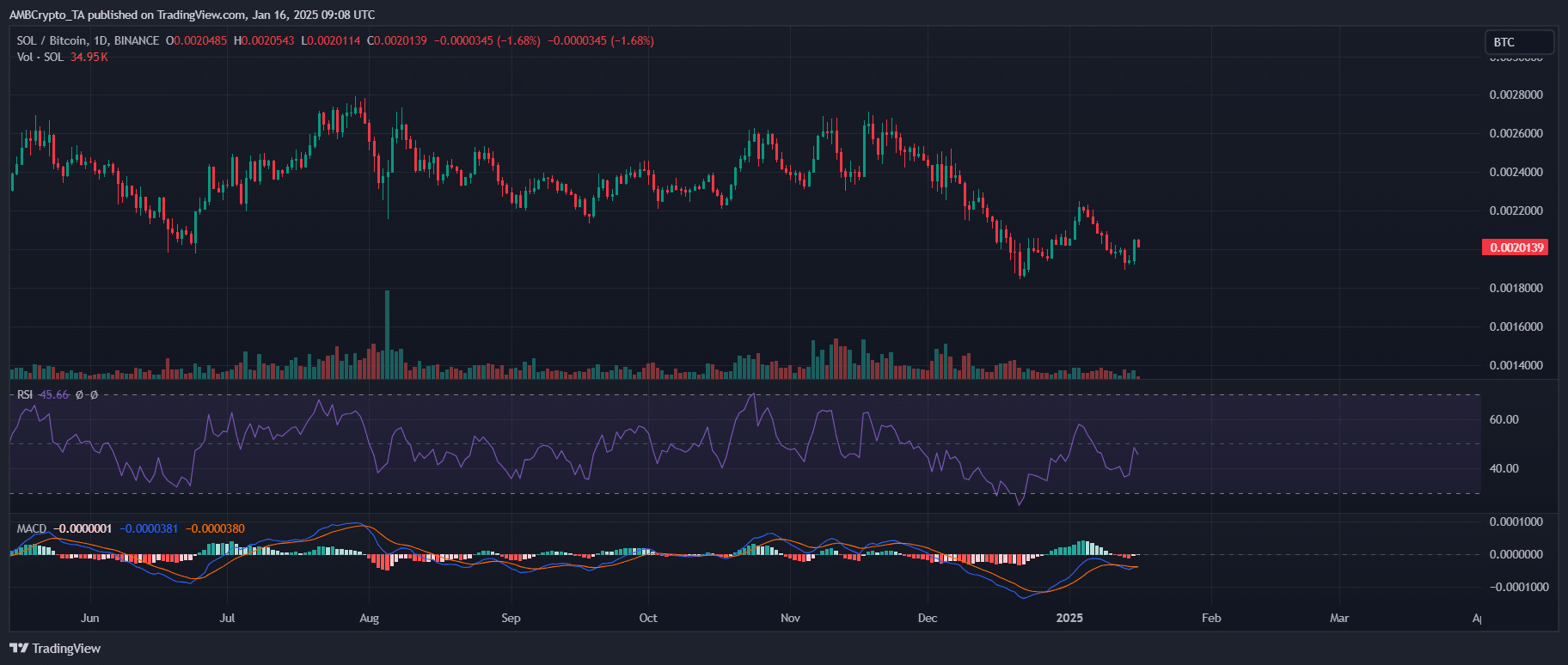

Solana, at the time of writing, was trading 20% above its previous dip to $168, with a neutral RSI and the MACD just turning bullish – Showing there’s still plenty of room for momentum to build.

Looking at the broader market, high-cap alts have been receiving fresh capital inflows, but none have broken key resistance levels – Except for XRP, which surged past its November highs.

For Solana to hit $220, it needs to climb by another 10% – A target that seems achievable in the short-term. However, despite its recent recovery, SOL’s erratic price action highlighted a key issue – Investors still lack sustained confidence.

With a 30% surge needed from its latest dip to hit that target, profit-taking could become a real concern – Especially if traders decide to cash out early.

On top of that, the SOL/BTC pair only saw 166.46K in volume, a far cry from XRP/BTC’s 55 million. No doubt, investors seem to be shifting their focus to other altcoins this cycle.