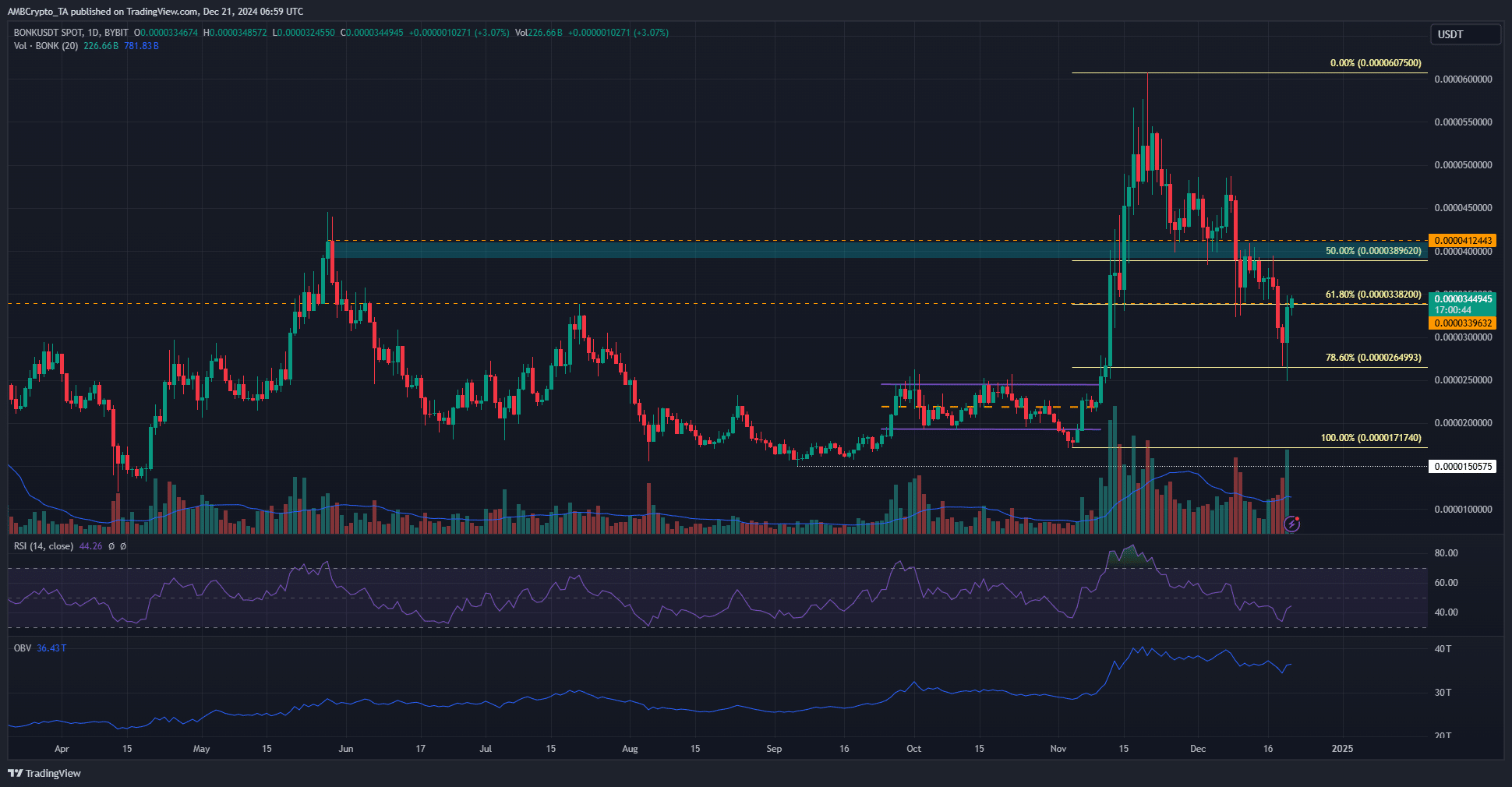

- BONK’s RSI and OBV revealed strong bearishness over the past month

- A bounce to $0.00004 might be likely, but whether the market structure can shift bullishly would depend on capital inflows

BONK fell by 59% in 30 days from 20 November to 20 December. This steady downtrend saw some sizeable selling volume on certain days, such as 9 December, when Bitcoin [BTC] faced rejection from the $100k- level.

Since then, the memecoin has struggled to hold key support levels. In fact, the latest BTC correction sent BONK to another vital support level at $0.0000265.

BONK bulls attempt to scale the $0.0000338 resistance

Source: BONK/USDT on TradingView

The daily RSI for BONK was at 44 and below the neutral 50, underlining bearish momentum. The OBV also made a series of lower highs and lower lows over the past month. Together, with steady losses since mid-November, it highlighted that the bears still had the upper hand across the market.

The recent drop forced the memecoin to retest the 78.6% Fibonacci retracement level at $0.0000264, but it did not close a daily session below it. Since hitting the local lows at $0.0000248 on Friday, the altcoin’s price has shot up by 39%.

The $0.00004 zone had been a support, then flipped to resistance in recent weeks. It is expected that it will serve as a stern resistance once again. A daily session close above $0.0000394 would flip the daily market structure bullishly.