Key takeaways

Why is Ethereum seeing record accumulation right now?

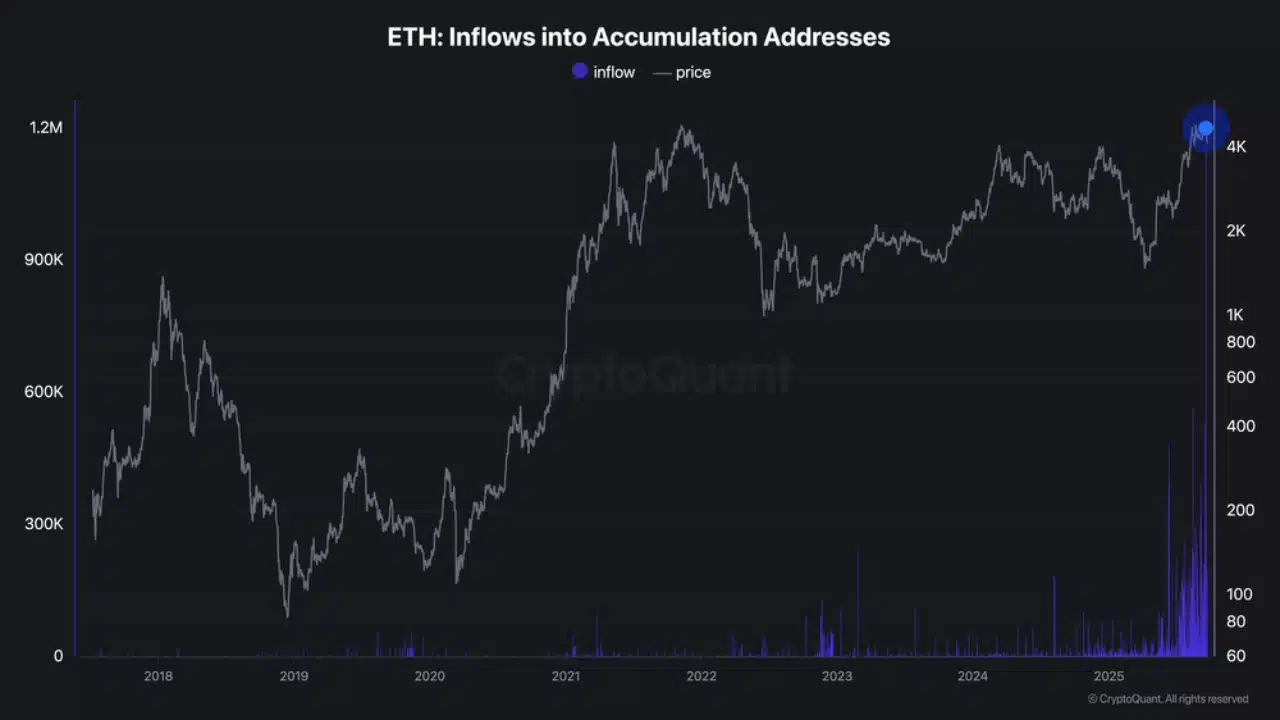

Because LTHs and possibly ETF-linked entities added over 1.2 million ETH recently and nearly 400K ETH on the 25th of September.

How does the Open Interest reset impact ETH’s outlook?

With over $5 billion in leverage wiped out, ETH may now have room for a more stable and sustainable recovery.

Ethereum’s [ETH] market is sending mixed but fascinating signals.

On one hand, long-term holders (LTHs) are scooping up ETH at a pace not seen before. On the other, Open Interest (OI) has taken a steep dive, with billions in leverage flushed out in just days.

Can this clean slate help with a healthier, more sustainable moves ahead?

Accumulators step in

Data from CryptoQuant showed that on the 18th of September, inflows into accumulator addresses surged to a record-breaking 1.2 million ETH.

This is the highest level in the network’s history.

On the 25th of September, another 400,000 ETH were added in a single day. These wallets, which only buy and never sell, are showing conviction, much like long-term investors or institutions.

The timing is notable, too: with ETH ETFs attracting fresh demand, it’s possible that some of these large inflows are by entities preparing for sustained exposure rather than short-term speculation.

Open Interest takes a big hit

Comments are disabled.